Shahid Sattar and Noreen Akhtar

Energy sector is the largest GHG producer in Pakistan. It is estimated that the energy demand in the country will reach 108 – 126 million tons of oil equivalent (TOE) by 2030. With the growing unsustainable management of energy demand, Pakistan’s continuous reliance on imported fossil fuels and outdated coal technology has affected the country’s energy security and its compliance to the global requirements on energy efficiency and decarbonization. However, the government’s recent tilt towards enhancing the country’s capacity for renewable energy (RE) consumption presents a major legislative and policy advancement.

The updated National Climate Change Policy, 2021 puts a major emphasis on achieving climate change mitigation goals via energy efficiency and reducing carbon emissions. It aims to seek technological breakthroughs to harness the country’s potential of renewable energy and declares that 60% of all energy produced in the country by 2030 will be clean through renewable resources and Pakistan will no longer pursue imported coal power plants. Further, Pakistan’s updated Nationally Determined Contributions (NDCs), 2021 support government’s energy-related policy interventions and have determined integration of renewable energy sources in all major sectors a high priority area. The updated Renewable Energy Policy 2019 focusses more on green energy and aims to reduce GHG emissions using Kyoto Protocol.

Pakistan has tremendous potential to fulfill its growing energy demand from the renewables including solar, wind, hydro, geothermal and biomass, as these resources are greatly available in the country. Solar, for instance, is the most attractive alternate energy solution which has received considerable attention recently. Pakistan’s southwest region receives the highest irradiation. “The annual global horizontal irradiance in the Himalayas and Karakorum is 2300 kWh/m2, which is the greatest of any other region on Earth”. Wind energy sources have a potential to generate 43,000 MW electricity. Moreover, the International Renewable Energy Agency (IRENA) estimates that Pakistan’s hydropower sector has a potential of 60GW and it remains a cheapest source of power in the country. Biomass is estimated to generate 50,000 Gwh/ year in the country. Finally, geothermal energy resources are present in all the provinces, which can be used for power generation, heating and cooling of buildings and supply of hot water.

If Pakistan brings into play this untapped potential in all the major sectors by implementing the exemplary policy reforms in spirit and expanding RE, a massive decoupling of growth from conventional energy resources such as fossil fuels can add to the existing efforts on climate resilience. RE expansion will make electricity cheaper, enhance energy security and Pakistan can save up to $5 billion over the next 20 years, as per World Bank’s report.

Pakistan’s textile industry is one major sector that can benefit massively from the available RE resources in the country while supplying eco-friendly power.

RE AND TEXTILE SECTOR

Textile industry’s manufacturing processes are energy intensive. 10% of global GHG emissions are accounted for by clothing and footwear production. Raw material production, harvesting, dyeing, and dumping of used textiles, all major steps involved in textile manufacturing and their discarding emit GHGs into the atmosphere. For Pakistan’s textile industry, transitioning to RE solutions is not only cost and resource effective, but also enhances the sector’s overall compliance to the global standards on energy efficiency and industrial decarbonization, such as those imposed by the European Green Deal. Government’s support, growing renewable energy market and technological advancement are among the already existing opportunities for the industry to expand its business through renewables. Government of Pakistan has supported RE development and encourages private sector involvement for projects related to carbon emissions reduction. The textile industry can become a leader in this, if it prudently plans right financial allocations to set up independent sustainable electrification. Also, RE technologies are becoming relatively affordable options for powering the industry that can enhance cost effectiveness of the manufacturing processes.

The industry’s current progress on offsetting emissions indicates that, it has shown promising commitment to achieve net zero by adopting a green supply chain philosophy. The Net Zero Pakistan initiative, for instance, is Pakistan’s largest net zero coalition and is the only second country-wide program, under Global Race to Zero, after Japan. It is a collaborative effort between non-government organizations, leading textile companies, public institutions and sector experts. The textile companies, in this coalition, commit to set science-based net zero targets, measure and disclose their GHG emissions, decarbonize their value chains and advocate for climate action. Keeping in view the extrinsic pressure and internal needs for energy efficiency, the initiative must facilitate decarbonization by increasing renewable energy mix and incorporating energy saving technologies.

Major textile companies are supporting climate action through clean energy initiatives including solarisation projects and technology installation such as waste heat recovery boilers and converting boilers to biomass based fuels. International certifications on energy conservation such as LEED are acquired and water stewardship through sustainable bleaching techniques, zero wastewater discharge and recycling is achieved. Performance comparison of one of the companies ‘Sarena Textile Industries’ is given in figure 1.

The analysis of the current scenario of industrial energy efficiency reveals that the share of alternate energy sources such as renewable electricity and biomass in the industry is limited. Technology such as motors and boilers are inefficient and innovative ideas to save energy are exercised inadequately. Thus, the major decarbonization and energy conservation pathway for the industry is to transition to renewable energy technologies including solar PV, concentrated solar thermal collectors and wind turbines. Circular economy options including recover, recycle and re-use must be compounded by rethinking process improvement options and innovative technologies via right financial allocations and research breakthroughs.

Figure 1: Performance comparison of Sarena Textile Industries

Figure 1: Performance comparison of Sarena Textile Industries

The industry can acquire Renewable Energy Certificate (REC) upon adoption of the RE technology. RECs are issued when one megawatt-hour (MWh) of electricity is generated and delivered to the electricity grid from a renewable energy resource. Pakistan has been approved for International-REC (I-REC) for electricity issuance. The I-REC for electricity issuer in Pakistan is the Pakistan Environment Trust (PET). RECs are tradable units and can be sold through exchanges or bilateral trades and can be a significant source of additional revenue generation.

LEGISLATIVE CHALLENGES AND THE WAY FORWARD

The industry is currently experiencing a number of barriers obstructing its transition to RE resources, that demand an immediate response from the government.

The limit of the present net-metering scheme for solar power systems of the industry is 1MW, which needs to be extended to 5MW – “especially when the demand of the large-scale manufacturing industry is between 1.5 to 5MW. This increase has a potential to add 5000MW of solar energy at no upfront investment from the GoP to the energy mix of the country. Furthermore, this will enable the EOUs to become competitive in the international market (with lower energy costs) and increase the share of renewables in the total energy mix as committed in the updated NDCs 2021.”

Further, government has planned to launch solarisation projects of around 14000MW which will not only “reduce the import bill of costly fuel but also help generate low-cost and environment-friendly electricity.” These solar systems will be provided at reduced prices and will be given tax incentives. However, in order to support the industry to enhance its energy efficiency in a sustainable and an independent manner, it should be permitted to install its own solar power structures with the extension of net-metering scheme for solar from 1MW to 5MW.

The wheeling case indicates that Pakistan needs to move towards free market models with multiple buyers and sellers to revive power sector but also, to make it transparent. The wheeling regulations must incorporate wheeling of renewable energy and the associated wheeling cost must be reduced for any industrial off-site installation of renewable power infrastructure.

These legislative burdens coupled with the withdrawal of regionally competitive energy tariffs are pushing the industry into a zone of financial dismay where it is operating at less capacity utilization due to working capital issues, losing competitiveness in the international market and raw material issues. This will cause long-lasting harm to the industry’s current compliance and sustainability efforts and adoption of RE technology, as the present focus has shifted towards another day survival by mitigating the impacts of withdrawal of energy tariffs.

In conclusion, Government of Pakistan must address the existing limitations of net-metering scheme for solar, wheeling charges and continue providing regionally competitive energy tariffs for the industry to regain sustainability progress and transition to RE. This will support the industry in utilizing the country’s current RE potential to the maximum, reduce reliance on fossil fuels and enhance competitiveness in the global export market. Otherwise, the government’s recent NCCP and NDCs that put extreme focus on RE will be restricted to paper without implementation in spirit.

REFERENCES

https://www.maxpower.com.pk/news/renewable-energy-in-pakistan-opportunities-and-challenges/

https://tribune.com.pk/story/2394481/pakistan-a-major-fossil-fuel-importer

https://energsustainsoc.biomedcentral.com/articles/10.1186/s13705-016-0082-z

https://www.s-ge.com/en/article/export-knowhow/20213-c5-pakistan-renewable-energy

https://online.fliphtml5.com/wokmg/yimk/#p=20

Shahid Sattar and Amna Urooj

The persistent deviations and inefficiencies in Pakistan’s energy sector have generated extremely negative impacts on both end-users and enterprises, stalling the country’s pursuit of sustained economic development. The textile industry, which constitutes a significant proportion of exports (60%), manufacturing sector employment (40%) and banking credit (40%), is acutely impacted by the high energy tariffs and circular debt crisis, requiring prompt attention to ensure stability in exports and employment.

Source: APTMA

Source: APTMA

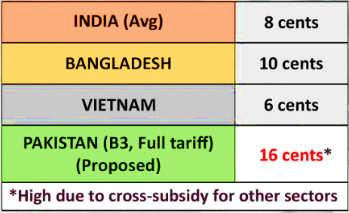

The textile sector is grappling with a severe lack of gas and RLNG, due to rapidly declining gas reserves and escalating limited import of RLNG due to high prices caused by the Ukraine situation. This shortage is unlikely to improve in the near future. As a result, the industry is turning more to electricity from the grid, despite its various challenges, such as lack of steam and dependability. For the textile sector to remain competitive, it is crucial that the cost of electricity in the region remains reasonable. The government had pledged a Regionally Competitive Energy Tariff (RCET) of Rs 19.99/kWh for EOUs until June 2023, but due to the ongoing economic turmoil and IMF negotiations, this RCET, has currently been cancelled starting March 2023.

Ironically, an analysis of the cost of service for B3 & B4 industry and that too as per data provided by CPPA/NEPRA, reveals that in actual the provision of a 9 cents/kWh taris involves no subsidy as can be seen below for FY22. According to CPPA/NEPRA calculations, the cost of electricity is 8.1 cents and excluding cross-subsidies plus transmission and distribution cost makes a total of 9.3 US cents/kWh.

Cost of Service for B3 & B4 Industry as per CPPA/NEPRA

It is also worth mentioning that the Small and Medium Enterprise (SME) sector, who do not have alternate energy sources, can face severe economic consequences due to withdrawal of regionally uncompetitive tariffs. The intense competition in the global export market and the crucial requirement for Pakistan to uphold or potentially increase its exports calls for caution in the context of elevated electricity charges. The SME sector is already at a disadvantage due to the absence of subsidized credit, difficulties in accessing import for re-export plans, and the incidence of multiple tax duplications. The imposition of higher electricity tariffs is likely to result in cost escalation, rendering the SMEs incapable of remaining competitive in the marketplace both for exports or local consumption as imports become relatively cheaper.

On the other hand, the non-implementation of the Textile Policy 2025 implies that the business environment in Pakistan is not conducive to the growth of both existing and new investors. Consequently, textile enterprises in Pakistan have become regionally uncompetitive in comparison to their counterparts in South Asian countries such as India and Bangladesh, resulting in an adverse outcome of the aforementioned factors. The economic losses arising from the aforementioned factors, both current and future, are significant and alarming.

Energy Tariff’s Across the Region

Source: APTMA

The issue at hand is: despite the potential for much higher exports by the textile industry through favorable policies and tariffs, the government’s inaction on this front remains inexplicable. It may be that policymakers and decision-makers are not fully cognizant of the benefits associated with such decisions or lack a precise understanding of the actions necessary to save the sector from collapse. Alternatively, it is possible that the industry is not adequately communicating and emphasizing these concerns. Nonetheless, APTMAs consistent efforts in promoting RCET have been instrumental in the past, creating a positive impact.

As a matter of fact, reliance on grid electricity at over Rs. 40/kWh makes the Punjab industry uncompetitive in international & local markets thereby, shifting the available orders to cheaper alternatives internationally as well as within Pakistan. This will consequently further break the already broken economic position of the country via unemployment, lower exports and bankruptcy. And now that it is evident that the withdrawal of RCET OF Rs 19.99/kWh and a gas tariff of $9/MMBtu for gas/RLNG in Punjab will result in closure of Punjab based textiles. Immediate intervention to correct injustice is requested from the policy makers as Pakistan can not afford further deterioration in the balance of payments which may amount to a loss of $10 Billion exports per Annum.

The revocation of RCET will render more than 50% of Pakistan’s installed capacity in the Punjab-based industry non-operational. Meanwhile, the Sindh-based industry will maximize gas usage, which costs 4 cents or Rs.11 per kWh, with added steam and hot water benefits. The cost of self-generation for Punjab-based industries using gas/RLNG will be 11.5 cents or Rs.31 per kWh. Additionally, grid electricity is both uncompetitive and unreliable, reducing effective production capacity by over 25% due to substandard supply. Furthermore, gas supply to the export sector in Punjab is severely restricted, meeting only 25% of the demand and only available to selected units when it is available at all.

Energy Differences Across Punjab and Sindh

Source: APTMA

This dolorous situation implies that the $5 Billion investment over the last three years that resulted in increased exports by a massive 55% in two years i.e., from $12.5 Billion in 2020 to $19.5 Billion in FY22 through the provision of RCET and Temporary Economic Refinance Facility (TERF) will all be lost.

During periods when the government provided regionally competitive energy tariffs, the Export Oriented Industries (EOIs) demonstrated the crucial role of these tariffs. This was evidenced by an immediate increase in production, reaching full production capacity, creating new job opportunities, attracting new investments, and leading to the full operation of all mills. It is unquestionably a sustainable path to economic growth to enhance trade competitiveness, as it is not subject to any liability, unlike aid. Additionally, tying hopes of economic growth to remittances is unreliable, as the long-term trajectory of remittances is unpredictable. Countries that have achieved economic growth and sustainable development prioritize export-led growth as their top agenda.

Another important aspect to consider is that when the Government of Pakistan borrows from the international bond, it typically does so on an interest rate of 7% – 8%. While foreign loans can provide much-needed financial resources to the government, their cost in the form of interest payments and debt servicing is a drain on the country’s resources, limiting the government’s ability to spend on critical areas such as healthcare, education, and export-led growth.

Cost of Regionally Competitive Energy Tariffs (RCET) to Textile Sector

Source: APTMA

In fact, depending on export-led growth is way better than any reliance on foreign loans and aids. When compared technically; the total cost of RCET as a percentage of textile exports from FY19 – FY22 was just 2.67%. Growth led export policies such as RCET can lead to increased exports and higher revenues for the industry against foreign loans with an interest rate of 7% – 8%. The difference in interest rate of external borrowings vs cost of RCET has significant implications for the government’s finances, saving billions of rupees as the government doesn’t have to repay for the later one.

On the other hand, one alternative solution to insulate SMEs from high energy tariffs, without violating any World Bank or International Monetary Fund conditionalities for subsidies, would be establishing an RLNG-powered or coal fired generation facility, aimed at catering to the energy demands of the textile industry. As a complementary initiative, exploration of the feasibility of setting up off-grid solar and hydro power plants in KPK to reduce operational expenses is also possible. However, this too has its own set of problems such as wheeling charges, stranded cost and cross-subsidy, issues of electric supply from grid, notice period, and solar net-metering CAP.

One of the challenges in establishing a power plant dedicated to serving Export Oriented Units (EOUs) in the Textile industry is related to the definition of open access/wheeling charges. With the discontinuation of subsidies, the industry must use the Competitive Trading Bilateral Contract Market (CTBCM) to remain competitive. In this context, the two disputed components out of the five components of the wheeling tariff, namely cross-subsidy and stranded cost, must be waived for EOUs. In order to remain competitive in the international market, the wheeling charge must exclude cross-subsidies and standard. Additionally, the current power wheeling system is inadequate for the CTBCM regime, and the supply of electricity is compromised as it does not conform to the grid and distribution codes established by the Government of Pakistan.

Pakistani policymakers need to prioritize sustained export-led growth to promote economic independence and overcome debt accumulated from loans and relief packages. A strong export base provides a self-sufficient and highly beneficial approach to strengthen the economy, free of any conditionalities. The ultimate aim is to achieve economic and political independence in Pakistan, free from reliance on goodwill or aid.

Related Articles:

- Ladder and the snake – https://www.brecorder.com/news/4694689/ladder-and-the-snake-20190522477837

- The snake has truly bitten – https://www.brecorder.com/news/4704478/the-snake-has-truly-bitten-20190702493518

Where We Are