by Shahid Sattar and Noreen Akhtar

INTRODUCTION

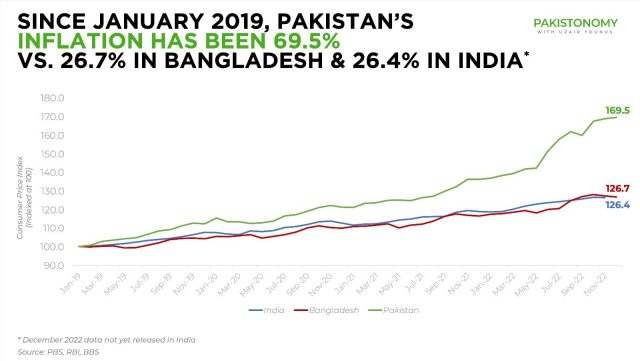

Pakistan’s export performance data and progress by the World Bank indicates that the country’s exports have reached around $35 billion, showing a 24% increase compared to that of 2020 (Macrotrends 2022). Pakistan’s Free Trade Agreements (FTAs) have, over time, reduced barriers to the export-led growth. For instance, China allows Pakistan a tariff-free access to its market. Also, EU’s GSP+ (Generalized System of Preferences) status allows duty and quota free market access to maximum exports from Pakistan. EU has remained the top export destination for Pakistan’s textile industry. In 2020, 75% of total exports made to EU were from Pakistan’s textile and clothing industry (European Commission 2022a). Pakistan’s exports growth to the EU has increased from around 26% in 2007-2013 to 47% in 2014-2021. However, considering a period of 9 years, the growth rate shows a comparatively slower pace (Javaid 2022).

Pakistan’s export market is heavily reliant on its textiles while the stability of textile industry’s exports is majorly reliant upon free access to the global market such as that of EU. Thus, Pakistan needs to enhance its eligibility under the EU’s GSP+ preferential status and utilize it effectively to make its export-led growth steady as well as to stay in line with other regional competitors including Bangladesh. GSP+ status is crucial for Pakistan to achieve a stable economic growth as in the absence of this status, “country would have to face an MFN Tariff of a maximum of 12% for most traded commodities under GSP+ and would also be paying an anti-dumping duty of 13% to the EU on cotton bed linen” (Javaid 2022). The status has also supported Pakistan to enhance its capabilities to grow in a sustainable manner, diversify its economy and create employment opportunities. It also accelerated Pakistan’s efforts in improving compliance to major human and labor rights and environment and good governance related international conventions.

EU awarded Pakistan the GSP+ status in 2014 and Pakistan, fortunately, became the largest beneficiary of GSP+ among all other awardee countries (European Commission 2022b). This status will end in December 2023 and its continuation is highly reliant upon a strong implementation of the 27 mandatory international conventions related to environmental and social compliance along with the treaties to be newly added. Therefore, Pakistan needs to accelerate its current efforts to fulfil the requirements of these conventions in all its sectors including the textile industry.

Pakistan has ratified all the compulsory international agreements required for the GSP+ renewal. These treaties fall under four categories: Human rights, labor rights, environment and climate change and good governance.

COMPLIANCE TO THE HUMAN RIGHTS CONVENTIONS

Pakistan has shown significant progress towards compliance to the human rights conventions. The country’s constitution prohibits torture and other cruel, inhuman or degrading treatment. The penal code prohibits criminal use of force and assault. The constitution orders free and compulsory education for all children aged 5 to 16, regardless of their nationality. Also, government authorities support NGOs/INGOs work to ensure safety of IDPs. Pakistan has also shown progress to human rights by proposing Protection of Journalists Bill 2021 and became the first country in South Asia to launch National Action Plan on Business and Human Rights. The Government also launched Ehsaas Program in 2019 supported by the World Bank, that aimed to develop a resilient social protection system via emergency cash initiative.

WOMEN

Women’s rights have gained considerate attention over past years. Rape is considered criminal offense. The following major initiatives took place to safeguard women’s rights in the country: Implementation of Women’s Protection Act, Punjab Protection of Women Against Violence Act, designation of special courts countrywide to have an exclusive focus on gender-based violence, KPK Domestic Violence Against Women Act 2021, introduction of cellphone apps to enable women to contact police, increase in research initiatives by the foundations on gender-based violence, operation of Crisis Center for Women in Distress by the government, Enforcement of Women’s Property Rights (Amendment) Bill 2021, Punjab government funding women’s career centers and crisis centers that provide legal and psychological services to women and emergency shelters for women and children, initiation of economic empowerment programs such as Kisan Ki Beti Project to enhance skill development of rural women, financially empowering women via initiatives such as Ehsaas Kafaalat Program, appointment of first female chief justice in the High Court (US Department of State 2021) and increasing awareness via peace marches such as Aurat March.

Moreover, regarding night shift hours for women employees, the Factories Act 1934 now known as Factories (Amendment) Act 2012, states that “no woman shall be allowed to work in a factory except between 6 am and 7 pm. With the exception, the Provincial Government by notification in the official Gazette, vary the limits laid down above to any span of ten and a half hours, or where the factory is a seasonal one, of eleven and a half hours, between 5 am and 7.30 pm.” Recently, however, Pakistan has supported women’s empowerment and allowed work in nights shifts. Sindh Assembly in this regards passed Sindh Factories (Amendment) Bill, 2021 and Sindh Shops and Commercial Establishment (Amendment) Bill 2021 to allow women work during night shifts under better work conditions. Both bills made the employers accountable to provide safe workplaces with better facilities including transportation for women working beyond 7pm (Tunio 2021).

MINORITIES, OTHER RACES AND ETHNICITIES

Racial and ethnic violence and discrimination is prohibited in all the sectors. According to Pakistan’s constitution, all citizens are entitled to equal protection before law and minorities shall be given freedom to practice their religions and cultures. The constitution also discourages racial, sectarian or tribal discrimination. Moreover, some of the initiatives at the country level that have ensured minority rights include the 2017 Hindu Marriage Law and KPK Rehabilitation of Minorities Endowment Fund Act 2020 (US Department of State 2021).

CHILDREN

Regarding children’s rights, the constitutional mandates have made education compulsory and free for the children aged 5 to 16, regardless of any nationality. Moreover, government has taken multiple initiatives to protect children. For instance, both boys and girls have access to the government medical care facilities. Sindh provincial assembly has passed Child Protection Authority Amendment Act 2021 to take strict action against child abusers. Child protection courts were inaugurated by the Peshawar High Court in KPK. Various laws aim to protect children from sexual abuse and cruelty and KPK government built hundreds of schools to educate internally displaced children deprived of education. The legislative progress includes launch of National Action Plan on Child Abuse and launch of National Child Labor Survey. Lastly, agencies were established to track child abuse and in response to the Zainab abuse case, Zainab Alert, Response and Recovery Bill 2019 was approved (US Department of State 2021).

PERSONS WITH DISABILITIES

The law supports equal rights for persons with disabilities and the responsibility of protecting their rights is given to the provincial special education and social welfare offices. There are departments or offices legally responsible to address educational needs of disable persons in each province in Pakistan. Pakistan also supports employment quotas at federal and provincial levels in public and private organizations to reserve 2% of jobs for persons with disabilities. Moreover, the National Council for the Rehabilitation of the Disabled had job and loan facilities for the disable.

OTHER SEXUALLY ORIENTED AND GENDER IDENTITIES

Pakistan has taken certain positive measures under UN Human Rights Conventions, to ensure rights of other gender identifies. Regarding transgender rights, Transgender Persons (Protection of Rights) Act 2018 was incorporated and government of Sindh, in 2019, announced to provide 0.5% of office jobs in Sindh police force to the transgender community. KPK province has also shown effective improvement regarding transgender rights. For instance, transgender prisoners are held separately to improve prison situation. There are dedicated intake desks for transgender persons in KPK police stations and transgender rights education is added to police training courses. Transgender sensitization trainings are also held for police officers in Punjab and Islamabad. Lastly, Supreme Court ruling allows transgender community to obtain national ID cards listing third gender to participate in elections as both candidates and voters (US Department of State 2021).

COMPLIANCE TO THE LABOR RIGHTS CONVENTIONS

After 18th amendment, most of the labor force in Pakistan is under authority of provincial labor laws. In Pakistan, the government collaborates with the labor NGOs to assist workers regarding capacity building, support establishment of labor unions to organize workers, advocate for the wellbeing of workers and to support workers get access to citizenship benefits. Moreover, the ministries in KPK, Punjab and Sindh worked to register brick kiln workers to enhance their access to labor courts and other services as well as to regulate the industry efficiently. Also, the government of Punjab supported Elimination of Child Labor and Bonded Labor Project to overcome child and bonded labor in brick kilns. Under this project, the workers were supported to obtain national IDs and interest-free loans as well as schools were established at brick kiln sites (US Department of State 2021). Government of Pakistan has also signed an MOU with ILO and launched Better Work Program to achieve decent work standards, especially in the export-oriented Textiles and Apparel sector, supporting the sector in improving labor conditions and enabling greater freedom of association.

Regarding prohibition of child labor and forced labor, in 2020, Pakistan’s federal government amended Child Protection Act 1991 and prohibited child domestic and other hazardous labor. Pakistan’s constitution prohibits employing children younger than 15 in any factory, mine or other hazardous sites. Moreover, some of the provinces such as KPK have set minimum age for hazardous work to be 18 which meets the international standards of minimum age for employment. Moving on, Baluchistan passed Baluchistan Forced and Bonded Labor System (Abolition) Bill in 2021 to prohibit forced and bonded labor as well as Baluchistan Employment of Children Prohibition and Regulation Act to protect children from hazardous working conditions. The legislative progress also includes launch of National Action Plan on Child Abuse, launch of National Child Labor Survey and Punjab’s Restriction on Employment of Children Act.

Compliance to the rights to acceptable working conditions has also received strong attention. KPK raised minimum wage standards and mandated women and transgender workers to receive equal remuneration. According to the law, maximum workweek hours are 48 with rest periods and paid annual leaves. Overtime pay, sick leaves, health care, social security and education for worker’s children are other basic facilities required to be ensured. In 2019, rights of women working in farming, livestock and fisheries were recognized via Sindh Women Agriculture Workers Act, ensuring their minimum wages, sick and maternity leaves, accurate working hours and right to collective bargaining and social security.

COMPLIANCE TO THE CONVENTIONS RELATED TO ENVIRONMENT AND CLIMATE CHANGE

Environment and climate change have received extensive devotion in Pakistan. One of the biggest accomplishments was an effective control on wildlife trafficking and raise awareness among communities regarding illegal wildlife trafficking and sustainable trophy hunting. The main stakeholders include Pakistan Customs as well as other bodies such as Ministry of Climate Change who supported relevant organizations through capacity building. Also, a system of

permits was established to transport rare animal species abroad and regular monitoring takes place at the airport. Lastly, law enforcement agencies were trained by WWF regarding illegal wildlife trade (Javaid 2022).

Pakistan has endorsed hazardous waste and chemicals related UN conventions such as Basel and Stockholm Convention. The Ministry of Climate Change has recently published National Hazardous Waste Management Policy and EPAs are responsible to monitor national environmental quality standards and regulate effluent release and pollution-oriented manufacturing in the industries.

Pakistan has ratified all conventions related to climate change and ozone depleting substances (ODSs). The global GHG emissions data indicates that Pakistan contributes to around 1% to these emissions (UNEP 2021). Energy and agriculture are the main sectors responsible for most of the emissions as 46% emissions come from the energy sector and 41% from agriculture (USAID 2016). The entire industry sector contributes 5% to the country GHG emissions. Although, Pakistan’s contribution to the global emissions is comparatively low, its GHG emissions are increasing at an alarming rate and so is its vulnerability to the climate change. To overcome these, the country has shown significant progress via substantial initiatives.

For instance, the Government of Pakistan (GoP) developed National Climate Change Policy (NCCP) as a major guideline to ensure climate change mitigation and adaptation in the country. NCCP was revised and updated in 2021 to ensure sustained economic growth by integrating climate change at policy level and fulfilling SDG implementation in every sector (Ministry of Climate Change 2021). Pakistan’s continuous efforts in overcoming GHG emissions also include updation of the Nationally Determined Contributions (NDCs) in 2021. Despite Pakistan’s financial needs remaining high, the updated NDCs aim to decarbonize its economy and enhance its climate resilience by cutting 50% emissions, shifting to 60% renewable energy and targeting 30% electric vehicles by 2030 (UNFCCC 2021).

Other legislative and policy actions to achieve greener Pakistan in future include Billion Tree Tsunami Program, Protected Areas Initiatives, Recharge Pakistan Project to reduce flood risks and enhance water recharge and National Action Plan on Sustainable Consumption and Production in collaboration with the EU.

COMPLIANCE TO THE CONVENTIONS ON GOOD GOVERNANCE

Pakistan has improved on part of the UN Convention on Corruption. Javaid (2022) states that “According to Financial Action Task Force (FATF), Pakistan has substantially completed its two action plans, covering 34 items and warrants an on-site visit to verify the reforms implementation.” Recently, this visit by the FATF’s technical team took place and the global money laundering and financing watchdog removed Pakistan from FATF’s grey list (Hussain 2022).

REMAINING CHALLENGES

Under the status of GSP+, Pakistan has shown a strong commitment towards ensuring social and environmental sustainability in the country. However, the progress needs to be enhanced and amplified to all the sectors.

The progress regarding human rights states that the right to free speech and press is subjected to restrictions. Blasphemy law restricts rights to free speech concerning matters of religion. Also, journalists and media platforms reporting on sensitive topics are subjected to harassment and violence. Also, national legislations regarding protection of refugees including access to basic services and employment opportunities are not endorsed (US Department of State 2021). Further, corruption is persistently observed in the politics and government.

Regarding women’s rights, spousal rape is not explicitly criminalized, rape survivors face procedural barriers to have access to courts and there is no centralized law enforcement data collection system in the country. Moreover, women become victims of honor killing and forced marriages and face legal and economic discrimination. Forced religious conversions, unlawful kidnapping and detentions, target killing and religious discrimination are other remaining concerns associated to human rights.

Pakistan also needs to advance its efforts in ensuring rights and safety of children. The major focus needs to be diverted towards monitoring and effectively implementing regulations regarding child abuse and sexual exploitation, forced early marriages and displaced children (US Department of State 2021).

Furthermore, rights of persons with disabilities require strong recognition in all sectors of Pakistan. The initiatives must focus on measures including education of children with disabilities, increasing employment quotas and improving access to public transport and health-care facilities. Lastly, marginalization of transgender women, violence against other sexually oriented persons, unlawful attacks on the families and residences of transgender community, mob killing and discrimination in employment, housing, education and other services require an effective consideration (US Department of State 2021).

The current progress regarding compliance to the labor rights conventions indicates that the provincial laws regarding collective bargaining excluded banking and financial sector, forestry and hospital workers and self-employed farmers. Relevant regulations are not enforced effectively to penalize those denying labor rights. Illegal strikes are strictly monitored and large scale strikes are often interrupted by the police. Moreover, forced and child labor still exists in Pakistan. The sectors are presented in figure 1 (Bureau of International Labor Affairs 2022). Children still work on hazardous sites, domestic workers are hired informally with no limits to working hours and inspection of child labor and minimum age requirements is a failure in the country (US Department of State 2021).

Occupational health and safety is another crucial area that requires maximum attention of the authorities. Workers are usually not trained regarding health and safety measures. Also, dangerous working sites such as mines lacking ventilation still exist and contract workers or the invisible workforce not in records usually fall victim of accidents (US Department of State 2021).

Initiatives regarding environmental safety and climate change have shown promising results. However, the relevant sectors are still facing prevalent challenges. For instance, due to inefficient monitoring, capacity building and financial instability, manufacturing industries including SMEs still use hazardous chemicals such as POPs and import unverified contaminants. This not only causes aquatic and land ecotoxicity but also creates hazardous working conditions for the workers. Moreover, the GHG emissions are increasing at an alarming rate and so is the country’s vulnerability to the climate change. Overall, there is a lot of scope for Pakistan to enhance its climate change adaptation and mitigation via proper utilization of funds, hunting international climate change grants as well as by ensuring an interdisciplinary approach to this change.

Figure 1. List of goods produced by child labor and forced labor (Bureau of International Labor Affairs 2022).

SUSTAINABILITY PROGRESS OF PAKISTAN’S TEXTILE INDUSTRY

SOCIAL SUSTAINABILITY AND COMPLIANCE

Pakistan’s textile industry can play a vital role in fulfilling human rights conventions in the country. As Pakistan’s major share of exports relies on textiles, the industry has a vital responsibility to act for the renewal of GSP+.

The industry, fortunately, is giving utmost attention to social compliance in all sectors. For instance, figure 2 presents the human rights principles targeted by US Apparel and Textiles to be addressed in 2022. Sarena Textiles has also added employee welfare in its major goals. Other initiatives by the textile industry to ensure human rights include Pheonix Project by Artistic Milliners that aims to fight gender-based violence by employing victims of acid attack, Enriching Lives Program by Gul Ahmed to provide training and employment to differently-abled people and Sapphire’s Deaf Reach Program providing trainings and employment to the deaf.

Figure 2. Targeted principles related to human rights, labor rights, environment and anti-corruption to be addressed (US Apparel and Textiles 2021).

The focus, however, needs to be enhanced by ensuring protection of all workers including those from the minority groups, transgender communities and disabled from unlawful conflicts. Moreover, effective monitoring against official corruption must be ensure to improve transparency in the sector. Effective regulations to ensure women’s safety need to be enforced. Moreover, the textile industry must treat every worker with different cultural, religious, ethnic and tribal background equally in terms of freedom of expression as well as social and financial security.

Further, Bureau of International Labor Affairs has marked Pakistan’s textiles as goods produced using child labor. Thus, the protection of rights of children needs to be a highest priority area for the industry. Child abuse must be monitored and regulated and child labor must be reduced to the minimum.

Compliance to the UN labor rights conventions is the matter most associated to Pakistan’s textile industry as it employs 40% of the total labor force (SDPI 2022). In order to make relations between business and human rights favorable, labor rights must be fulfilled.

Pakistan’s textile industry has added fulfilment of labor rights in its main agenda. This is successfully followed by an increase in trainings related to labor rights, provision of fair remuneration and allocation of fair working hours as well as elimination of child labor. For instance, figure 3 presents the 2022 sustainability challenge map of one of the textile companies which is US Apparel and Textiles. It clearly highlights the assurance of labor rights and prohibition of forced and child labor in the industry (US Apparel and Textiles 2021). Moreover, Interloop is another major textile company that, as a result of its initiatives to ensure human and labor rights, achieved the following people impacts in 2021:

- 25,000+ people provided with decent work and employment opportunities

- 4000 children provided with quality education at 29 TCF schools

- 8000+ empowered through lean tool and trainings

- 500 young women and men equipped with higher education

- 2028 women working at interloop

- 25,000 patients provided with free healthcare facilities

- 6000 local talent promoted through sports events

The efforts, however, need to be enhanced. To achieve this, the industry needs to ensure freedom of association and encourage collective bargaining by providing workers relevant labor rights related trainings and education. Moreover, strong inspection of labor rights implementation needs to be ensured by the social compliance departments. This includes monitoring of forced and compulsory labor, extra working hours without wages, hazardous working conditions, freedom of speech, gender discrimination as well as child labor. Also, special departments must be associated to inspect the child labor element.

Figure 3. Sustainability challenge 2022 mapping (US Apparel and Textiles 2021).

ENVIRONMENTAL SUSTAINABILITY AND COMPLIANCE

Pakistan’s textile industry has incorporated the long-ignored principles of environmental consciousness in its agenda. One of the examples is presented in figures 2 and 3, which indicate the major environment and climate change related principles and sustainability mapping set to be addressed by the US Apparel and Textiles. Interloop is another great example which has, as a result of its green initiatives, shown the following environmental impacts in 2021:

- 7,390,289 KWH energy saved which is equivalent to energy used by homes for one year 631

- 21,295 Tons of GHG emissions avoided which are equivalent to tree seedlings grown for 10 years 352,117

- 81,864 M3 water saved which is equivalent to daily water consumption (based on 6-member family) 68,220 families

(Interloop 2021)

Sarena Textiles encompasses a range of environmental matters of global importance including responsible sourcing, water stewardship, energy conservation, carbon footprint reduction and certifications and transparency. Crescent Bahuman Textiles has achieved crucial certifications including OCS, GRS, Higg index, ZDHC, ISO 14001, Cradle to Cradle, Oeko-Tex, GOTS, and WRAP. Its major environmental initiatives include enhancing carbon sink, shift to renewable energy sources and rainwater harvesting. The Crescent Textile Mills Limited (Crestex) has prepared its sustainability roadmap to present its vision 2050. It has aligned its development and all activities to achieve this roadmap. This roadmap indicates that Crestex has envisioned to reduce its carbon footprint and achieve net zero by 100%, reduce unsustainable water consumption, shift its development to the renewable energy sources as well as reduce landfill waste and comply with the ZDHC requirements (figure 4).

Other initiatives taken by Pakistan’s textile industry to achieve environmental sustainability by reducing carbon footprint and increasing water conservation include revolutionary zero waste dying technology by AGI Denim, initiation on rainwater reservoirs of 6 million gallons by KMLG, GHG reduction via Heat Exchanger Rehabilitation Project by Al Rahim Textile Industries and sustainable textile bleaching by Interloop.

However, the industry is still facing major environmental issues. For instance, land and marine ecotoxicities are major environmental concerns associated to Pakistan’s textile industry (UNCTAD 2021). Thus, the industry needs to significantly enhance its efforts to make its manufacturing less pollution oriented. This can be done by banning import and use of hazardous chemicals, updation of effluent treatment plants (ETPs) and improving safety standards to use and store hazardous chemicals. The industry needs to regularly update its members regarding lists of chemicals of concern and most hazardous chemicals which are frequently updated by the international bodies and top export destinations such as EU, UK and US.

Figure 4. Crestex’s vision 2050 (Crestex 2022).

Furthermore, the textile industry contributes around 9.5% to the country level industrial GHG emissions and 0.095% to the global GHG emissions. The emissions from the industry, however, are showing an increasing pattern (USAID 2016). Therefore, industrial emissions need to be monitored and efficient technology needs to be installed to filter hazardous air pollutants. Also, textile industry needs to shift its focus towards renewable energy sources to combat climate change.

EU is one of the major export destinations of Pakistan and EU’s GSP+ status allows tariff-free access to Pakistan’s exports to the EU. Pakistan is the largest beneficiary of GSP+. This status has not only supported Pakistan grow its exports, the country also has enhanced its capabilities to grow in a sustainable manner and diversify its economy and create employment opportunities. It also accelerated Pakistan’s efforts in improving compliance to major human and labor rights as well as international conventions on environment and good governance.

GSP+ ends in December 2023 and its extension is crucial for the country to boost its export-based GDP but also, to shape its development sustainably. The country, in this regard, must fulfill the requirements by all the mandatory international conventions on human rights, labor rights, environment and climate change and good governance. The current efforts are crucial and require global appreciation; however, they need to be enhanced in all the sectors. Pakistan’s textile industry also needs to enhance its current efforts, especially regarding labor rights and environment and climate change.

The current practices and efforts indicate that Pakistan has not utilized the GSP+ status to the maximum and therefore, it must reshape its development in all the sectors and align it with the international requirements to achieve sustainable development. This will not only help Pakistan enhance its trade capacity; the country will also increase its job market, stay in line with its export competitors such as Bangladesh and implement SDGs in every sector by socially and environmentally complying to them.

Figure 1. Pakistan’s exports to the EU.

Figure 1. Pakistan’s exports to the EU.